The lack of data central bankers have on home buyers is appalling

Ask any central banker about the housing marker and you're likely to get the same answer: We don't know.

Now consider this:

- The number one cost for consumers -- by far -- is housing

- The largest component of inflation is shelter

- The top way central bankers directly affect almost all people is via mortgage rates

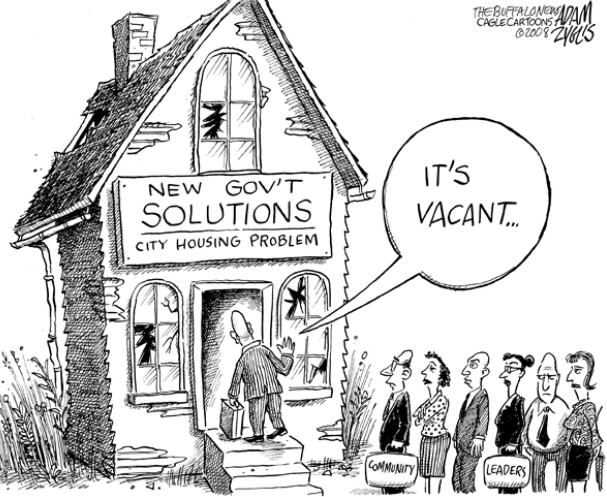

Yet central bankers are woefully, embarrassingly shorthanded and inept in understanding what is going on in the housing market.

On Thursday, Reserve Bank of New Zealand Governor Graeme Wheeler spoke about a recent discussion with BOC counterpart Stephen Poloz. He related that Poloz guessed investors were behind 10% of all Canadian purchases. In New Zealand, Wheeler said people were looking into the numbers and they're as high as 46% in Auckland.

That's a huge, hardly-believable discrepancy.

Foreign-owned properties are an even bigger mystery. Canada has virtually no data on who owns houses. The government is starting to look into it but has allowed tax-evading-enabling, identity-hiding purchase practices for so long that there's no way to untangle the mess.

Did central bankers learn nothing?

To recap: We're still recovering from a global financial collapse that was triggered by real estate lending and speculative markets where officials had no idea, nor any data about what was going on.

Basically all the information they have, or all they care about, is price.

This is perhaps the biggest source of foreign investment in your country. It's definitely the largest purchase the vast majority of your constituents will ever make.

Understanding who is buying houses in foreign-money hotspots like Vancouver and Auckland is tremendously important for central bankers. It will give them a fighting chance to react if China stumbles.