Reversal in oil and soft retail sales crush the Canadian dollar

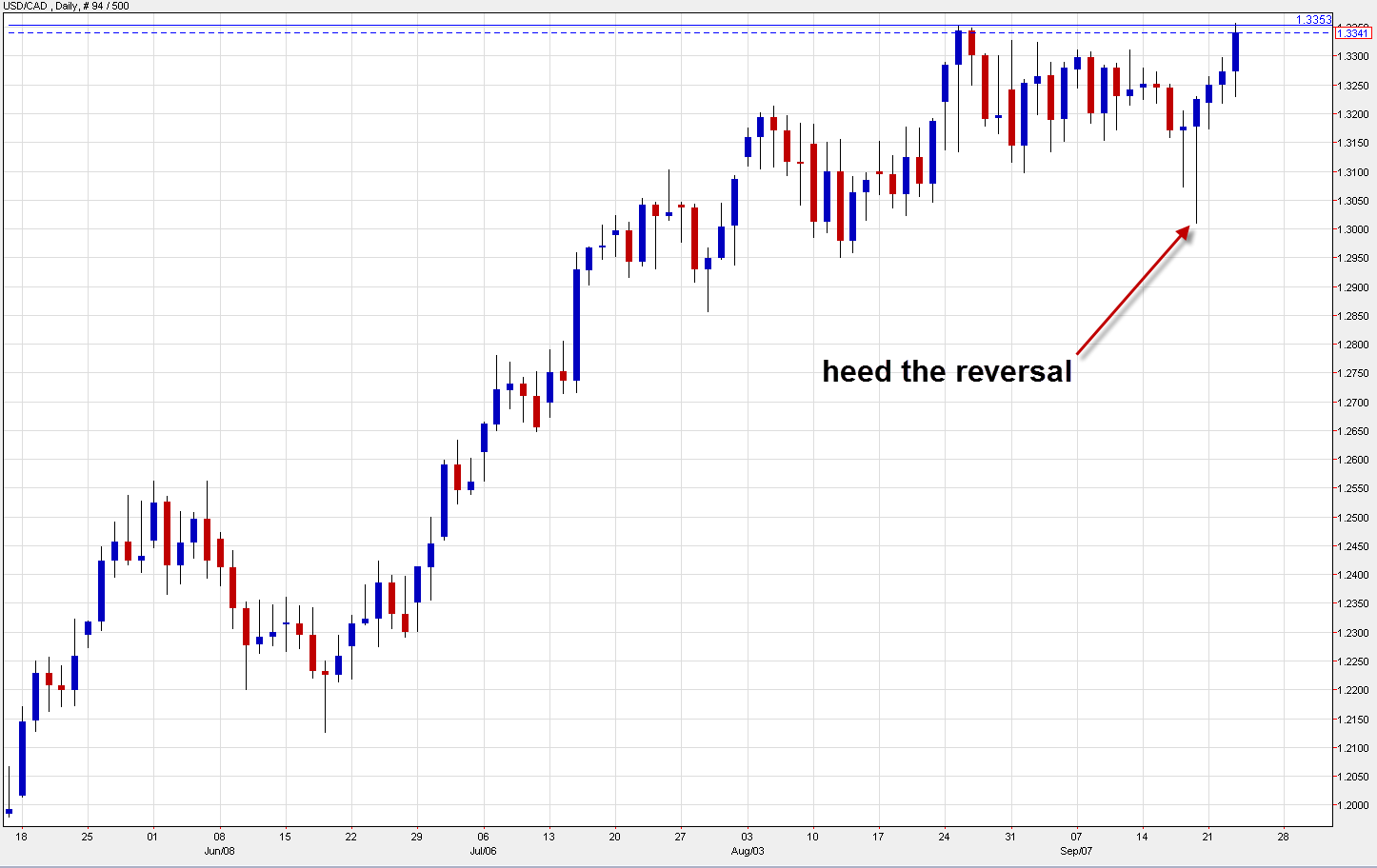

The US dollar is broadly stronger and pushed to the highest level against the loonie since 2004 in a flourish over the past few hours.

General US dollar strength along with a fall in oil prices drove USD/CAD to 1.3357, just above the late-August high of 1.3353. Canadian retail sales data from earlier today was also weak.

The pair has risen for five consecutive days following a drop on the FOMC. The Fed decision led to a quick 2 cent fall in the pair but it reversed by the end of the day and to finish higher in what was a bullish technical signal.

A similar type of reversal took place today. The pair dropped to a slow was 1.3226 as North American traders were arriving at their desks and then rose to 1.3315. A second round of selling followed the US oil inventory report but bottomed at 1.3248.

That came two hours ago but oil couldn't maintain the move and reversed, taking the Canadian dollar with it. WTI crude is down $1.19 to $45.16 after hitting as high as $47.15.

What's next for the Canadian dollar

This doesn't look good for the Canadian dollar. The only thing that's been keeping the loonie afloat is good domestic data and retail sales today were soft. If that's the start of a series of poor economic reports, then the outlook is dire. I've long expected the pair to hit 1.40 along with fresh lows in oil.

The x-factor for the pair is the Federal election on October 19. In general, the impacts of elections in stable democracies are far overstated and that's likely to be the case in Canada but that doesn't rule out a kneejerk move on the results.