Distinct downcast tone in statement

You have to give the Bank of Canada credit for communication. The BOC statement does a great job of speaking for itself in plain language.

It boils down to something like, "growth was slower in H1 than we expected and it's looking like H2 might miss as well but we're going to wait and see."

Here are some of the current and future positives they note:

- Consumption

- Healthy jobs market

- Recovery in oil production

- Rebuilding in Alberta

- Government spending

- Global financial conditions have become more accommodative

Current and future negatives

- US economy was weaker than expected and investment could be weak

- Drop in exports was larger and more broad-based than expected

- Even after adjustments, exports were weak

- Signs of a possible moderation in Vancouver housing market

Ultimately, it boils down to two lines. One saying there's a possibility growth will be lower than expected and another saying there's a risk inflation will disappoint.

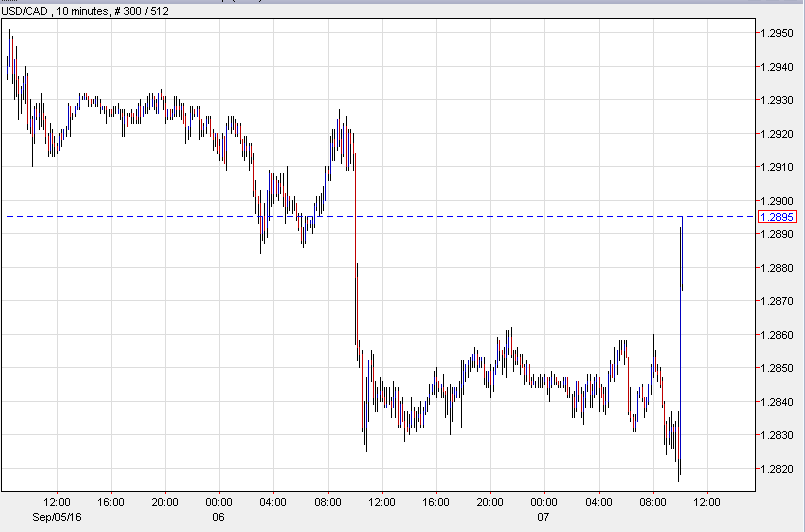

USD/CAD responded with a jump to 1.2890 from a session low of 1.2823 just before the announcement.

Before the announcement, the market was pricing in a 13% chance of a cut in December or January but you have to bump that up after this statement. I'd put it around 20-25%. Given that, there is the potential for more Canadian dollar selling in the hours ahead. Beyond that, look for larger reactions to economic data as the market and BOC watch closely.