From CitiFX Strategy, comments on the CHF and the referendum

This is via the good folks over at eFX

Calling SNB Bluff: Limited Scope To Respond To CHF Strength Before The Referendum - Citi

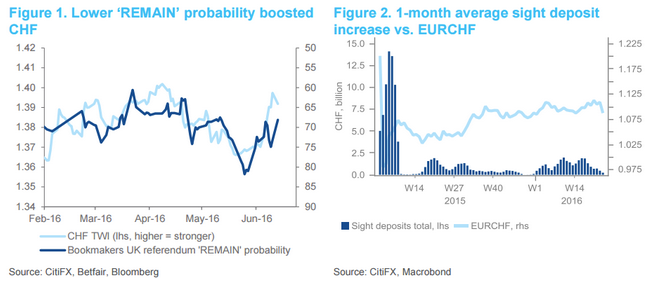

Absent the upcoming referendum, this week's policy meeting would probably pass a nonevent. We see limited scope for the SNB to respond to CHF strength before the referendum. This means if polls don't push LEAVE probabilities lower, CHF stays strong shorter term. CHF seems to be strengthening on referendum led uncertainty (Figure 1).

Without clarity on the referendum results, policymakers won't know whether to expect recent capital inflows to persist. This makes cutting rates or shifting exemptions inadvisable despite recent speculation. The persistence of the shock is hard to judge. Therefore policy responses aren't justified and the SNB may intervene less (grow the balance sheet less). Flat sight deposits tell the same story (Figure 2).

Our baseline sees CHF slightly stronger as a result. This persists unless polls/odds move in favor of REMAIN. Broadly, we like using the CHF rally as a chance to buy mid-dated topside.