Interesting confluence of the moving averages between 1.4414 and 1.4433

Junkers comment that a deal with the UK could be possible has helped lift the pound. There's still a long way to go and he is but one beak among many who will be chirping their opinion today. I'll be very surprised if they all follow his rhetoric.

There's not much else going on news wise right now so the market goes where the biggest risk might be, and that's the quid and the EU summit.

This pop has given us some idea of what moves those headlines might give us, so expect a fall just as quick as this rise if we start getting some negative comments.

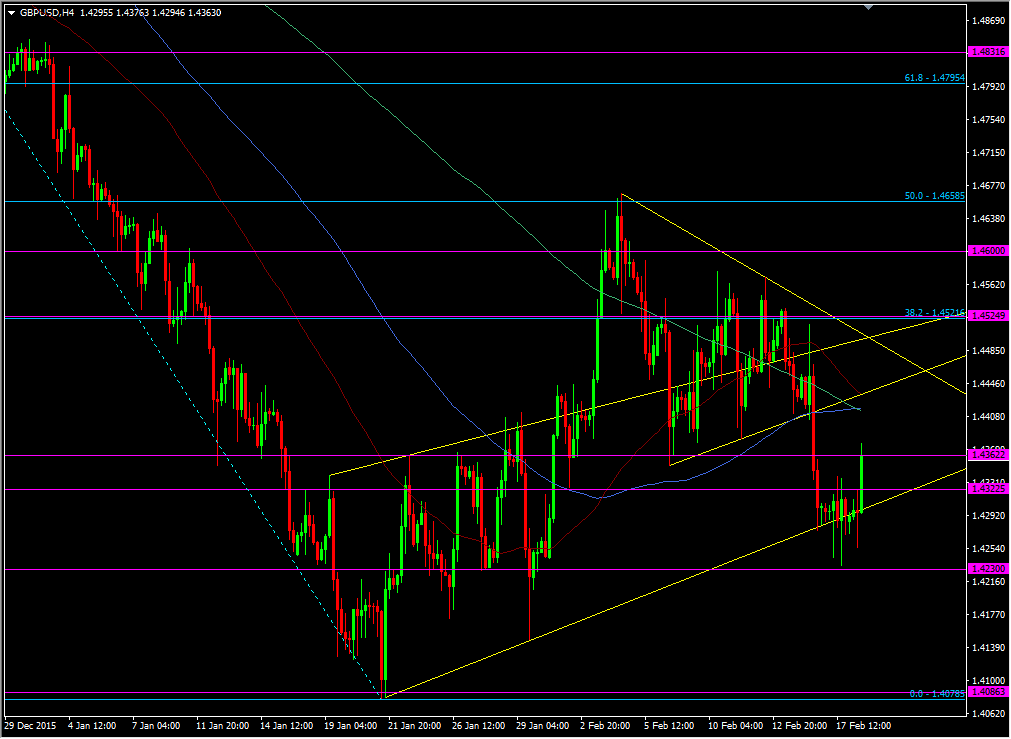

In the meantime there's a rather nice looking shindig of moving averages happening on the four hour chart in GBPUSD.

GBPUSDH H4 chart

Between 1.4414 & 1.4433 we have all three ma's close together. Adam also noted the break of the Feb wedge and that could feature here again.

Finding many tech levels in one place is one of my favourite patterns to trade. The nature of the four hourly means that I assign less strength than the same pattern on a daily or higher timeframe but if the conditions are right then it's worth looking at. Technically there's enough there to interest me in a short starting just ahead of 1.4400, to play the big figure first, then add at the 100 & 200 ma and place a stop above the 55.

Any really big news like the UK getting everything it wants from Europe without any hindrance and the levels are likely to count for nothing. If it's a hotchpotch of good news tied with a million and one conditions then the levels could be where that good news tops out.

The ECB minutes and the Philly Fed are the other risk events. The ECB minutes would have to be very dovish to sink EURGBP, and thus exert some upward pressure on GBPUSD. The Philly Fed is one of those numbers that the market either jumps on or ignores, depending on its mood.

Overall I see around 40-50 pips of possible risk trading these levels, which isn't bad based on what's there. To summarise, big news and I'll leave it alone, moderate news (or a slow drift up there) and I'll trade it.

We've got to get there first so let's see what pans out.