The black stuff hit by the perfect bearish news

You've got to give some credit to oil right now. The manufacturing data would have been the perfect tonic for sellers today

We've put on over 6 bucks in the last three full days of trading and while down today, it hardly looks like collapsing

The OPEC news yesterday has a lot to answer for, as well as production data from the US

Brent took itself above 52.50 and is messing around at the level once more. The 55 dma at 54.63 has a part to play in the highs as well

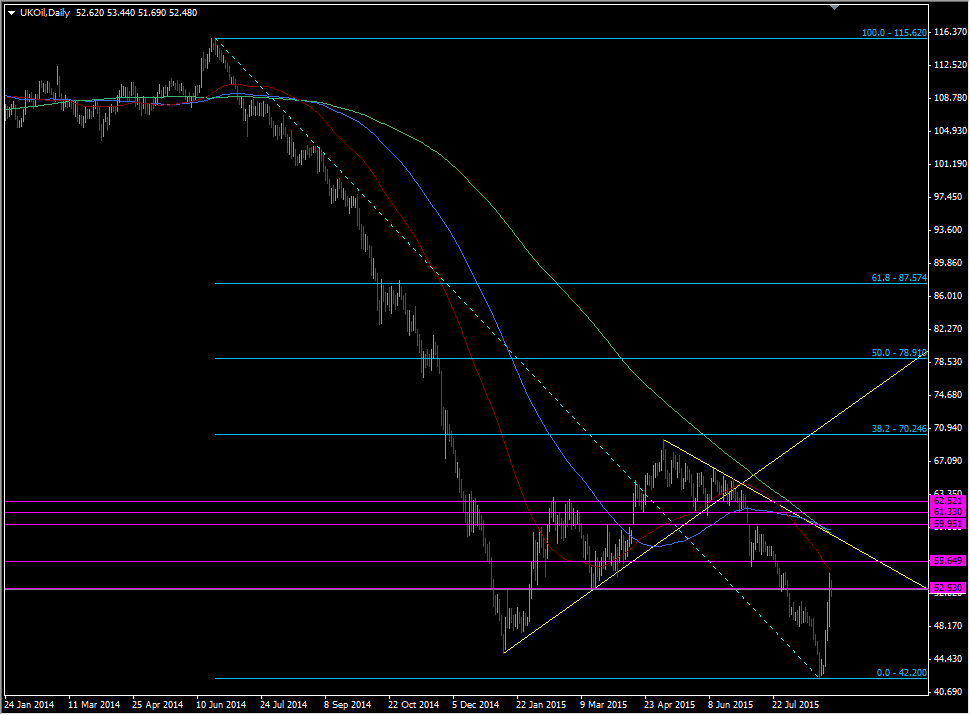

Brent crude daily chart

Whether you believe in the news or the reasons for oil rising, the technical picture up around $59.00-60 makes a short look very enticing. The 200 and 100 dma's come in with the May downtrend around 58.90, and prior support and resistance at $60

Oil can be a wonderful technical market when it's not going mental so I'm going to watch these levels closely. There looks to be decent levels to build shorts all the way to 62.50, though as always, we judge any moves on their merits at the time. It's definitely one to watch though