Next round of inventory data puts the proverbial skids under the oil rally

Any strong speculative move is fine until reality hits and it's hitting in oil right now. Fundamentally there's nothing that's really changed in the supply/demand picture so there's a strong case to say this recent rally is based on a fair amount of hot air.

It's being noted that the upcoming inventory numbers could inject some reality back into oil markets and that's causing risk to be reduced there. While the inventory data is for the US, the message overall is still one of oversupply in both oil markets.

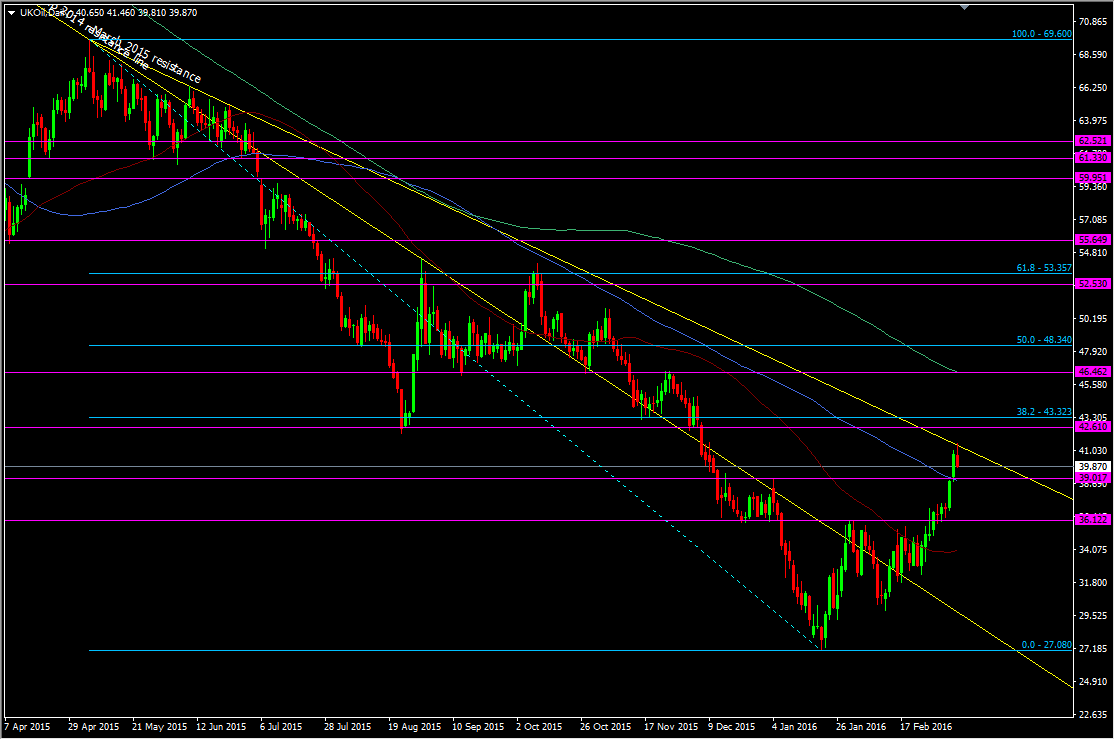

Brent crude daily

The old March 2015 resistance line has been where the price topped out and support will need to hold at 39.00 to save the rally from a deeper retracement down to around 36.00. The 100 dma at 38.90 could be bigger line in the sand.

Above, 42.20-60 holds the next resistance ahead of the 38.2 fib of the May swing down. If I was looking to short oil then the area around 46.00-46.50 would be my preferred target and it's backed up by the 200 dma also.

When oil is going batty the tech rarely stands up to the price moves so, the stronger the better is my usual basis for a trade. If the inventory data shows a large drawdown then the rally is likely to continue, even though that's short term news. If it carries the price to the 46's then I'll be waiting.