Bank of Japan concludes its monetary policy board meeting

- Monetary base unchanged

- 0.1% negative rate, unchanged

- Loan support program for banks in areas hit by quake

Headlines via Reuters:

- BOJ says keeps monetary policy steady

- Will take additional easing steps in 3 dimensions of quantity, quality and interest rate, if needed to hit price target

- To adopt loan support programme for banks in areas hit by southern Japan quake

- Total amount of loans for new fund supply operation is set at 300 bln yen

- Will provide loans to banks at quake-hit area at zero interest rate

- Japan core CPI expected +0.5 pct in fy2016/17 vs +0.8 pct projected in January

- Japan core CPI expected +1.7 pct in fy2017/18 vs +1.8 pct projected in January

- Japan core CPI expected +1.9 pct in fy2018/19

- japan real GDP expected +1.2 pct in fy2016/17 vs +1.5 pct projected in January

- Japan real GDP expected +0.1 pct in fy2017/18 vs +0.3 pct projected in January

- Japan real GDP expected +1.0 pct in fy2018/19

BOJ quarterly report:

- Japan consumer inflation to hit 2 pct during fiscal 2017

- Japan econ likely to expand moderately as a trend

- Negative impact on prices from energy price falls likely to remain until early fiscal 2017

- Pickup in exports moderating

- Private consumption is firm although some weaknesses seen

- Industrial output is moving sideways but seeing some effects from earthquake in southern Japan

- Inflation expectations rising as a whole in somewhat long-term perspective but weakening somewhat recently

- Companies are maintaining their positive stance towards setting higher prices for their goods

- Expected rises in wages will gradually push up inflation

- Must be mindful of risk that market uncertainty, slowdown in emerging markets could hurt business confidence

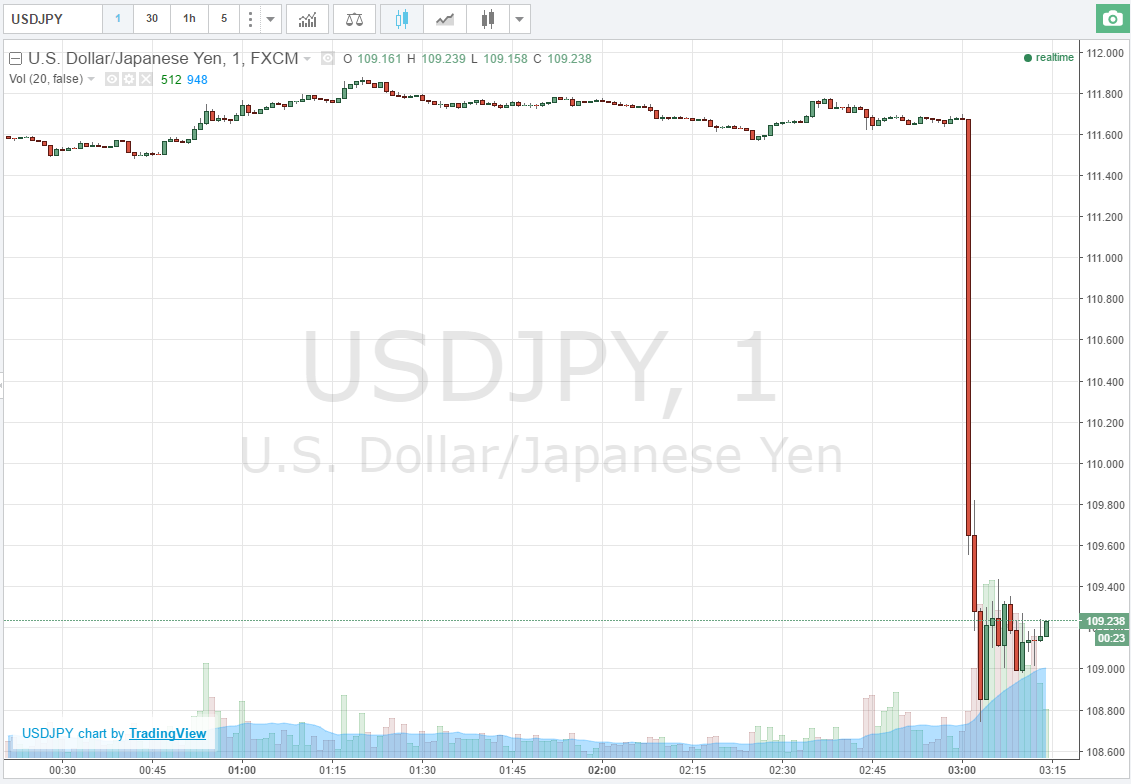

USD/JPY (and yen crosses) absolutely smashed lower on the news

Blood

bath