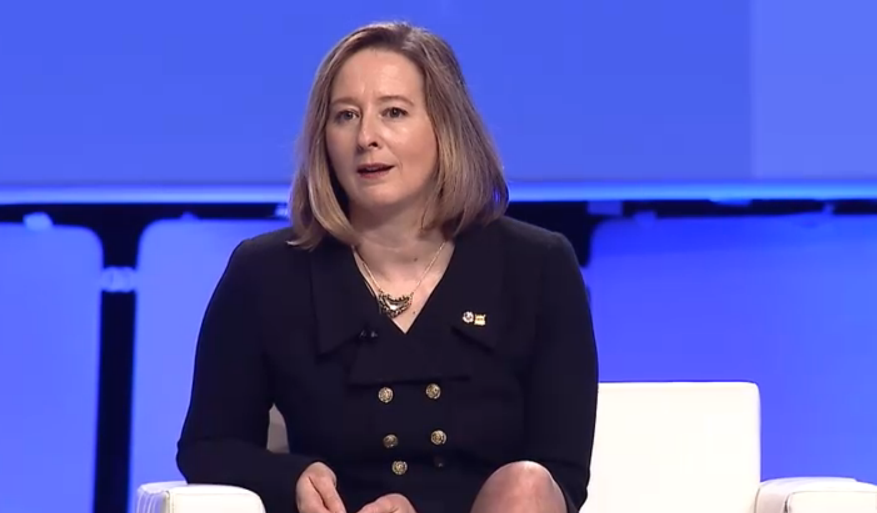

Bank of Canada Senior Deputy Governor Carolyn Wilkins in Montreal:

- Says BOC neutral rate lower than it was years ago

- Estimates neutral rate is between 2.75% and 3.75%

- Focus is on downside risks because there seems to be many of them

- Real interest rates have been negative, even deeply negative, many times

- Negative interest rates seem to be working in the countries where they're implemented

- Monetary policy is doing what it needs to do but it's not the only game in town

- If we get rid of cash, rates could go even more negative

- BOC doesn't need to deploy toolkit now

The Toronto housing market would collapse if BOC rates ever rose to 3%. Canada is levered up to the final dollar.

A live stream of Wilkens' comments is here.

That comment on cash and negative rates could come back to haunt her and other central bankers. The people out there who think the government is trying to steal all their money will look at something like that as a battle cry not to give up physical cash.

More:

- Liquidity is not where we expected it would be at this point in the cycle

- There are some issues in Canadian government bonds, not entirely sure why

- Liquidity is a big preoccupation for us

- Fiscal policy more useful than low rates now

On the same panel, John Major, global head of fixed-income research at HSBC, said it's obvious 'someone' will monetize debt in next five years. He's talking about Japan.