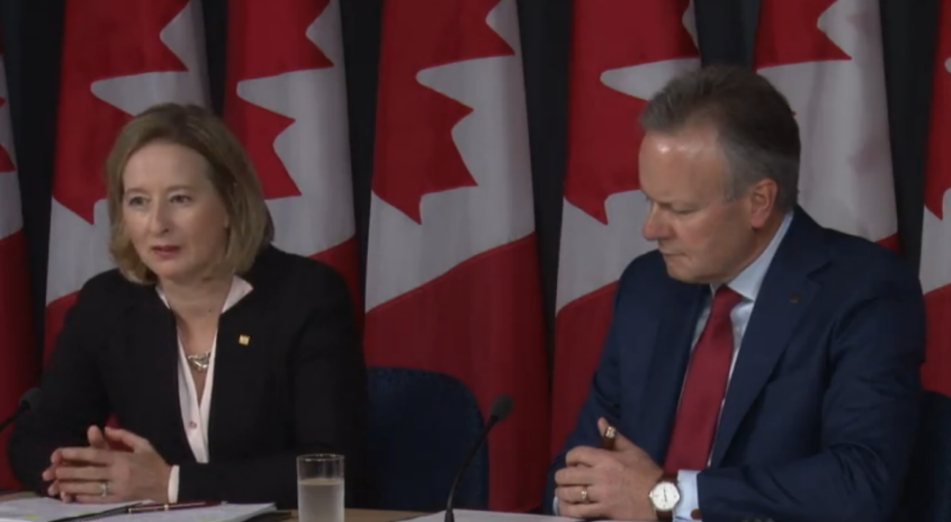

Comments from Wilkins and Poloz in the Bank of Canada press conference:

- Wilkins: house price gains in part explained by fundamentals

- Markets functioned quite well through Brexit

- Home price gains still look unsustainable

Wilkins did all the early talking but Poloz then took the lead

- Poloz: Fiscal measures to add about 0.5 pp growth each year

- Infrastructure funds will begin to flow this year

- Family tax cuts already flowing into Canadian economy

- It will take some time to fully understand Brexit impact

- April export data probably overstated underlying trend

- Export recovery alive and well

There is significant skepticism regarding the BOC's thesis that non-commodity exports will replace commodity exports. He's touting that non-commodity exports have recovered to 2007 levels but in 2007, USD/CAD was at parity. So in USD dollar terms, non-commodity exports are still down about 30%.

If you read between the lines, he's moving the goalposts a bit. He's saying that non-commodity export growth has topped and will only grow in line with global growth. Even that's a stretch.

- BOC has been purposely conservative on export outlook

- Declines to comment on whether Canadian dollar is too strong

- Asked about 2014 estimates that said housing was "10-30% overvalued", responds that those forecasts are "not relevant" (It was just a "piece of research to inform discussion")

The press conference has now ended. Overall, it was the worst BOC press conference in a long time. Poloz was extremely defensive and touchy.

I mean, his base case was that housing was overvalued and that non-commodity exports would boom. The opposite has happened in both cases and he was trying to pretend like the BOC was right all along.

Overall, the tone of the press conference was more downcast than the statements.