BOC Governor Stephen Poloz and Senior Deputy Carolyn Wilkins at the House of Commons Standing Committee on Finance.

- Dollar is consistent with historical relationship to oil

- Positive forces to emerge in the second half

- Rate cut and lower dollar aiding recovery

- Lower oil has already hit consumer spending

- Global policy easing should aid growth this year

- Labor market shows signs of improvement

- "We anticipate a partial rebound in growth in the second quarter, and a move to above-trend growth thereafter, for annual growth of 1.9 per cent this year"

- Our belief is that investment is underway, we're quite confident in the recovery

- We've lost a number of manufacturing companies in the past 5 years, the ones that are left are nearing zero excess capacity and will need to invest

- We think the US economy has been interrupted by bad weather and a port strike

- Lower CAD is 'absolutely' a net benefit

- Wilkins: Alberta housing market seems to have stabilized

- Wilkins: Whatever happens in Alberta, we're not expecting it to spill over into a problem affecting broader financial stability

- Poloz on housing: "We don't believe we're in a bubble"

- It would be unusual to have a cycle like we had in housing and not have a degree of overvaluation

- Reiterates that degree of housing overvaluation is about 20%

- We haven't been "anywhere close" to the need for QE

- BOC modeling with Brent $60, WTI $55 and $40 for Western Canada Select

- Underlying inflation around 1.6-1.7%, should move up to 2%

- 'Insurance amount' was about right on Jan 21 cut, referring to rate cut

Here is the full text of the opening statement. The appearance is expected to last 90 minutes.

Poloz today

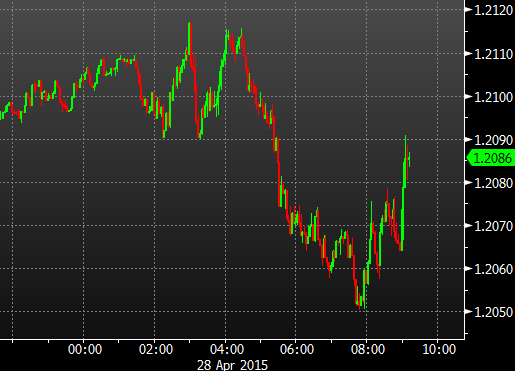

USD/CAD is about 20 pips higher since he began but there hasn't been anything in his comments screaming to buy. If anything, the opposite. It sounds like they believe growth will be stronger than their forecasts.

USDCAD intraday