BNP have revised their call for the next Federal Reserve rate hike ... big time.

BNP were saying no hike right through 2016 and 2017 ... but are now forecasting a hike in September.

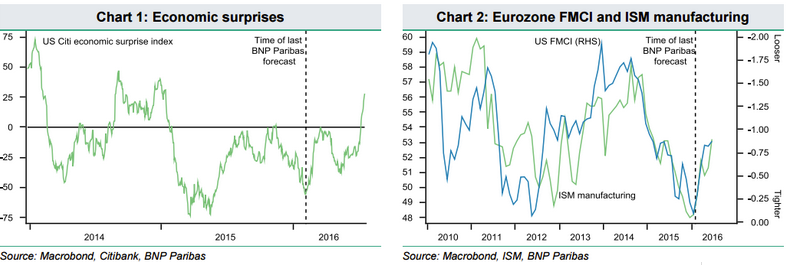

The market is too complacent about the US Federal Reserve. Better data of late and an easing of financial conditions have prompted us to reviseour Fed forecast.

We now see a rate hike as soon as September, with a small chance of an increase in December as well. A sharp weakening of risk markets could challenge our view, however.

Softer consumer spending over the next year as real wage growth slows will likely result in growth of only 1½% in 2017. We don't see the Fed hiking further against such a backdrop.

The next steps towards a hike should be a more upbeat FOMC statement, a more hawkish set of minutes and speeches saying risks have diminished. Data will decide the timing.