Bank of America Merrill Lynch preview on the BoE, via eFX

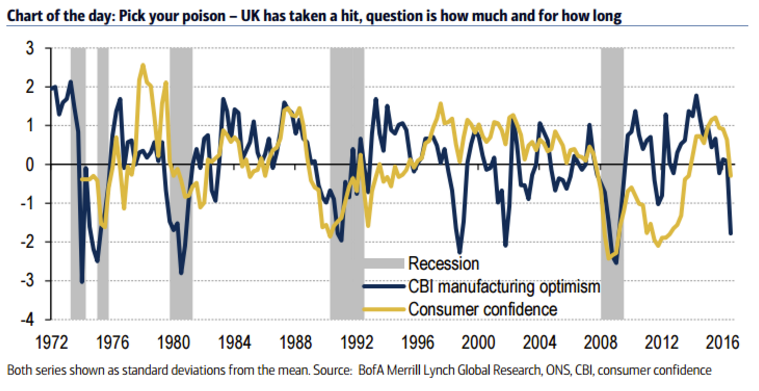

The UK soft data looks bad (Chart of the Day): the economy has taken a big hit and may be in contraction. Rate setters will have to cut their growth forecasts heavily in the 4 August Quarterly Inflation Report and highlight the downside risks, though we do not expect them to forecast recession (just).

The BoE should throw the kitchen sink at the problem: the worst thing that could happen now is the stimulus does not work, so better to do too much. Dismal data since the BoE's last policy meeting (which rate setters seemed not to expect) and MPC member Martin Weale's dovish flip-flop suggest less risk of disappointment. If the services PMI is lowered on Wednesday the BoE will be under more pressure to go large. We look for a 25bp rate cut, £50bn QE split between gilts and corporate bonds, and 'credit easing'.

In rates, a greater chance of QE has been priced in recently. However 10y spreads suggest to us our base case of £50bn is not yet fully priced. We continue to like 5s20s gilt flatteners.

FX: GBP Implications:

Following the July decision to keep rates on hold, we believe that Bank of England cannot afford to disappoint again as far as FX markets are concerned. However, we doubt a 25bp rate cut would be sufficient for a sustained break below 1.30 in GBP/USD.

Given the recent run of poor data and the decision by MPC member Martin Weale to reassess his view on the UK economy, the market is now fully priced for a rate cut. The extent to which the market is priced for a QE response is harder to calibrate, but we doubt this would come as a total surprise given the terms upon which the Bank of England has spoken about the need to respond to the current period of heightened uncertainty.

Nonetheless, a rate cut accompanied by a QE response would be initially negative for the currency as GBP rejoins the ranks of the funding currencies (JPY and EUR), but without having the luxury of a current account surplus. However, we are cognizant of the recent trend where central banks have delivered further QE, but their currencies have subsequently rallied.

The key to whether GBP weakness can be sustained is the extent to which the Bank of England forecasts leave the door open for a further policy response in the months ahead.