Highlights of the Bank of Canada rate decision on October 21, 2015:

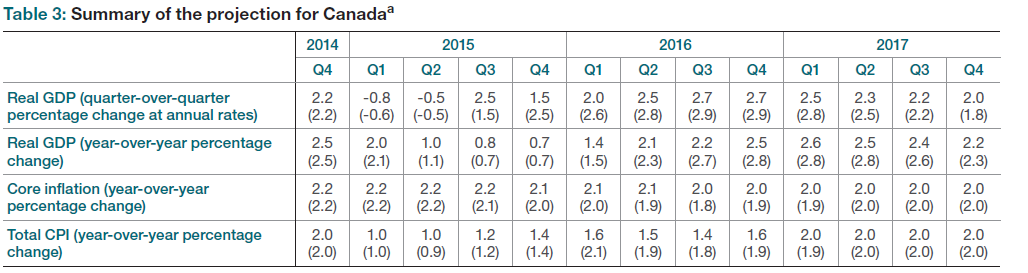

- Lowers Canadian GDP forecasts for 2015, 2016 and 2017

- Sees economy returning to full capacity around mid-2017 versus July estimate of H1 2017

- Continued neutral stance "The Bank judges that the current stance of monetary policy remains appropriate."

- "Judges that the risks around the inflation profile are roughly balanced."

- Canadian economy has rebounded as projected, signs of strength more evident in non-resource investment

- Sees Q3 GDP at 2.5% from 1.5%

- Sees Q4 at 1.5% from 2.5%

- Sees 2016 growth at 2.0% vs 2.3% prior

- Sees 2017 growth at 2.5% vs 2.6% prior

- Weaker business investment profile suggests near-term growth in potential output more likely to be at lower end of bank's estimates

- Lower oil, commodity profile are dampening business investment

- Sees global growth at 3.4% in 2016 vs 3.7% previously

- US economy expected to continue growing at solid pace

- Full text of the Monetary Policy Report

- Full text of the BOC statement

- At 11:15 am ET (1515 GMT) Poloz will hold a press conference

USD/CAD was slow to react but it's jumped up to 1.3068 now. That's the right direction. Pushing back the closing of the output gap is dovish despite the neutral stance. Any further deterioration in the Canadian or global outlook (or a fall in oil prices) will cause them to cut rates again.

There is a consistent theme of lower forecasts and those 2016 inflation forecasts are getting dangerously close to something that would call for a rate cut.