Its no secret that capex has been declining from the heady days of the mining investment boom, and lower expectations are a reflection of this.

- For today, the headline expected is -4%, while the prior was -5.2%

- Data hits at 0130GMT

As some background (I've posted this before, its via NAB and other sources, but recapping it here):

- More than most other rich countries capital expenditure is a huge part of the Australian economy

- For the past fifty years new capital expenditure has run at around 25-30% of GDP in Australia compared to around 20-25% of GDP in the United States

- The historically large amount of Capex in Australia reflects the abundant economic opportunities which in turn are the result of a rapidly growing population (the population grew 1.7% in 2013) and a vast geography with under-developed resources

- The most recent peak for Capex was near 29% of GDP in Q4 2012, as investment in the mining/resource sector peaked

- Since then, mining investment has slumped and total capital expenditures have been falling in real terms

- The challenge for the Australian economy is for something to fill the gap left by the downturn in the resource sector Capex

- Residential construction is helping, as is public sector infrastructure

- But the RBA have been hopeful of a recovery in Capex by non-mining firms

-

OK, so onto the most recent result, the link to the Q1 result is here

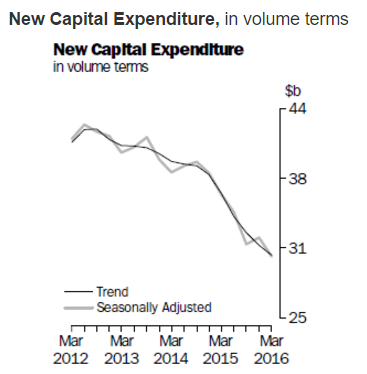

You can see the 'capex cliff' decline in expenditure in this graph:

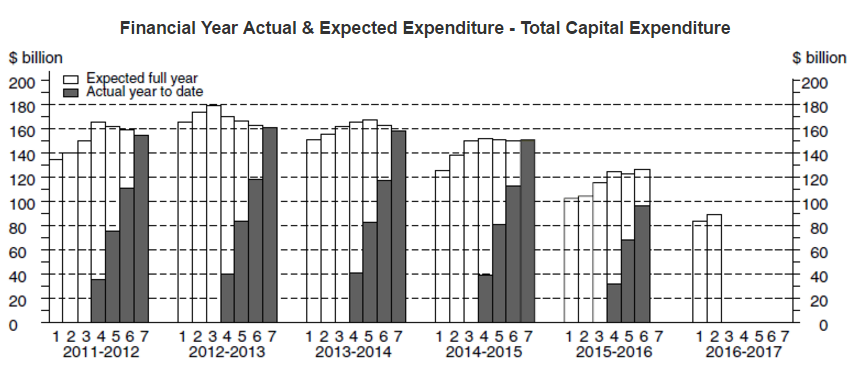

And here:

--

For today ...

As well as the 'headline' number most focus will be on " Estimate 3 for 2016/17"

- Estimate 2 was $89bn (you can see it above, in the column on the far right of the lower graph)

- Estimate 3 is expected to be slightly higher (historically around between 7 and 9% higher). The consensus Bloomberg estimate is at $97bn.

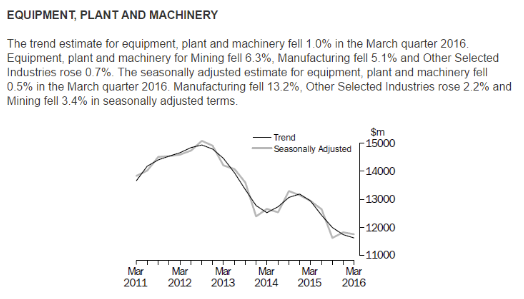

Also for today, there will be focus will be on "equipment, plant and machinery" as this gets fed into next week's GDP data for Q2. Its showing a similar, falling, pattern as the rest of capex, from the previous release:

--

Also at 0130GMT is the release of July Retail Sales data, expected +0.3% and prior +0.1%