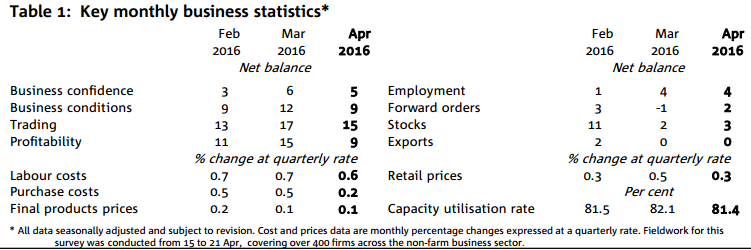

National Australia Bank Business Confidence & business conditions for April 9the survey is of around 400 firms monthly)

Confidence 5

- prior 6

Conditions 9

- prior (March) 12 (highest in 8 years)

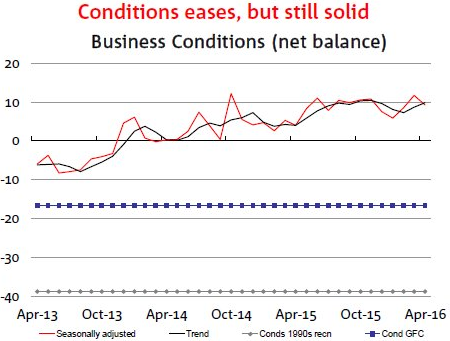

- "Even though business conditions eased this month, they have remained well above average levels for the past year", said Alan Oster, Chief Economist. According to Mr Oster, "with consistently good results like these from our survey it is difficult not to have a degree of confidence in the near-term outlook". Overall business conditions fell by 3 points to +9 index points in April, but remained well above the long-run average of +5. The trading (sales) and profitability components both eased in April, but remain quite positive, while employment held onto the gains achieved last month - suggesting ongoing resilience in the labour market.

Comments from NAB:

- The NAB Business Survey continues to point to a very favourable business environment for Australian firms, despite giving up some of the strong gains witnessed in last month's survey

- Service industries have persistently been the best performers, although other sectors including manufacturing and transport are looking relatively upbeat.

NAB are looking for a rate cut from the RBA tomorrow:

- Given these result, we have maintained our upbeat near-term outlook for the Australian economy.

- However, subdued inflation pressures in the Survey and a very weak CPI result for Q1 suggest the RBA has scope to further cement the non-mining recovery with an additional cut to the cash rate at its next meeting (although it is likely to be a close call).