Australia - AIG Performance of Manufacturing index for July

A good sized, and unexpected jump back into expansion from the Australian manufacturing PMI

- Comes in at 50.4

- From 44.2 prior month

- Up 6.2% on the month

Key points from the Australian industry Group:

- Conditions across the industry were broadly stable (readings above 50 points indicate expansion) (seasonally adjusted)

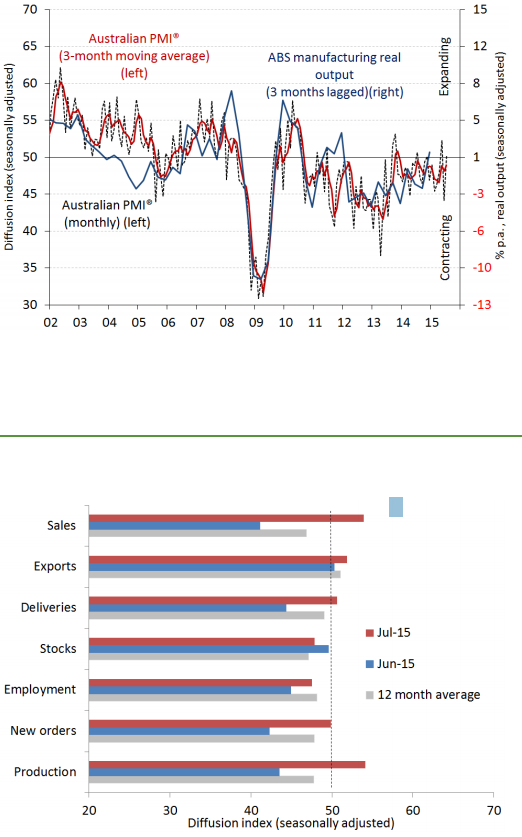

- The Australian PMI typically 'leads' ABS data for manufacturing output by around 3 months

- Recent results from the Australian PMI suggest output growth in manufacturing (measured as 'value added' by the ABS) is likely to have been flat in recent months, after achieving small recoveries in industry-wide output in the six months to March 2015

- Three of the eight manufacturing sub-sectors expanded in July: food and beverages (for a 14th month); wood and paper (for a fifth month); and petroleum, coal, chemicals and rubber products

- Four of the seven activity sub-indexes expanded in July. Manufacturing sales expanded for the first time in 14 months, while production and supplier deliveries both returned to expansion in July after contracting in June. However, stock levels contracted for a sixth month and employment fell for a second month.

- More positively, manufacturing exports expanded for a third month in July and for the sixth month so far this year, reflecting the lower Australian dollar

- Australian PMI® respondents' comments highlight stronger local demand flowing through from increased residential construction activity and continued strength in demand for food and beverages. Elsewhere however, weak consumer and business confidence, the progressive closure of local automotive assembly, and further declines in mining and other business investment in machinery and equipment continue to drag down local demand