Finally someone answered the doorbell on AUDUSD

I hate this pair. It squeezed the life out of me when shorting it above parity years ago. It's one of those pairs that can defy monetary policy, economic data, the cricket team losing the Ashes to England, among many other things. Whatever gets thrown at it just doesn't stick.

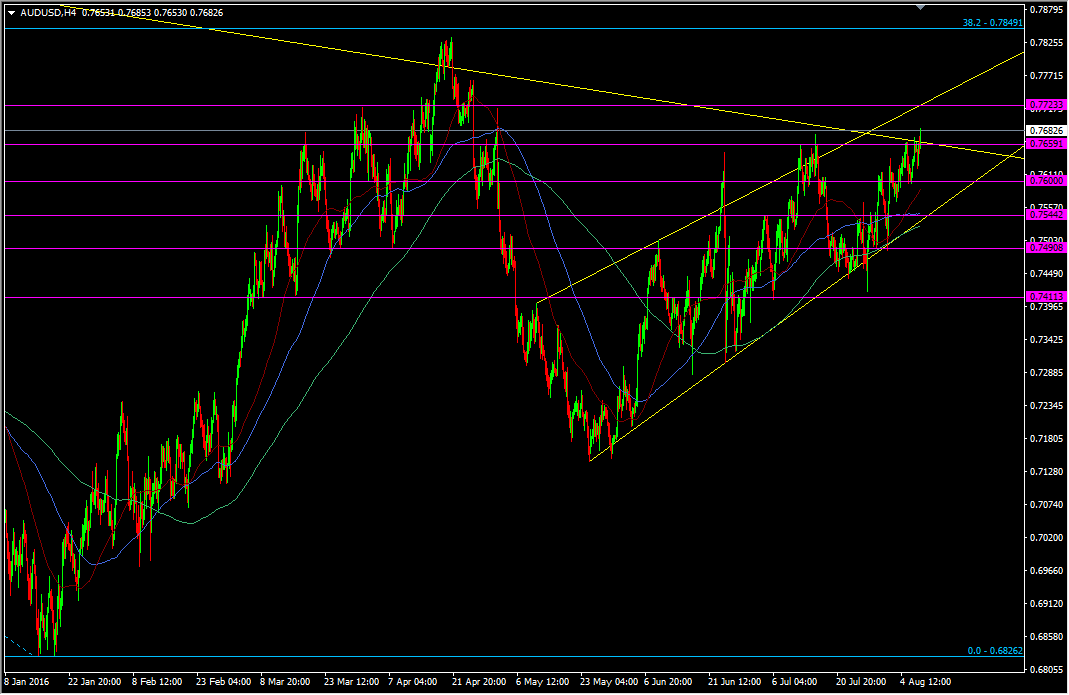

So, we've been watching the 0.7660/80 level many times this year and I've been watching it for the past week. After persistent knocking at the door, it's opened and through we've gone.

AUDUSD H4 chart

Now because me and this pair don't get on, because I'm long from Friday, it's going to squeeze me for every pip I'm trying to make from it. It's like that neighbours dog who loves everyone except you. It will roll over for anyone else but as soon as you walk past, it gives you that evil stare and starts growling.

When we see strong levels in currencies that hold time after time, what usually happens is that pressure builds so that when it does break, it breaks hard. The longer it holds, the harder the break. If I wasn't in this it would probably be trading at 0.7750 in an explosion.

But enough of my battles with it, what will happen now?

We've really only jumped one hurdle and there's more work to do as we approach 0.7700, and the next resistance above that at 0.7720/25. We then face more resistance at around 0.7765/70 from the Jan 2015 trendline. Above there we then might take a look at the 38.2 fib of the July 2014 drop at 0.7849. That's backed up by the 200 mma at 0.7877.

If the price is to push higher, and not suck everyone into a fake out, what we need to see is 0.7670/60 becoming support now. Then we'll have the battle between there at 0.7700. While I'm long, I want to see 0.7725 taken and become support before I'll believe this move is real. Until then I'll be trailing my stop up just in case.

Support has shown itself at 0.7640 and 0.7620. Trade through 0.7580 and we might see more downside. In my mind though, it would take a break of 0.7480 to change the landscape for this pair so dip buying is still my preferred method going forward.

All jokes aside, one of the main reasons why the Aussie was so strong in the early years of the crisis was the yield factor. Even with rates now much lower, there is still value in AUD assets, and in this global very low yielding environment, there are still those who will favour taking near 2% in something like aussie ten year bonds than US 10's at 1.5%, and that will help keep the pair underpinned.