Client note out from National Australia Bank courtesy of our friends at efxnews.com

Say NAB:

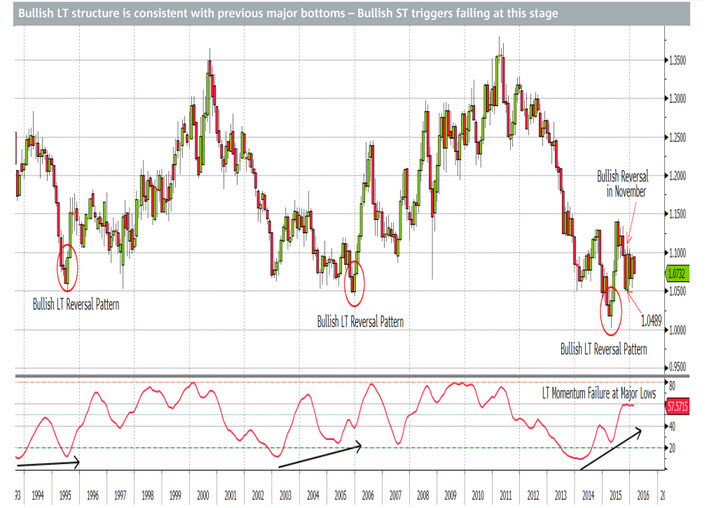

The LT downtrend that began in 2011 bottomed on April ahead of an impulsive 14% bounce in the following three months. The structure of the 2015 bottom is crucial to our ability to project a high probability outlook for AUD/NZD.

The key elements are the common factors that existed at the major lows of 1995, 2005, and 2015. Each was around the 1.00/1,05 level and was completed with a bullish monthly candle pattern while LT momentum produced a significance failure (did not make a new low with price).

Further, each major bottom produced an immediate rally of a significance ahead of a material retracement. We view price to be in that material retracement currently. November's bullish reversal implies that the retracement is over. It's important that the November low of 1.0489 holds of this the case.

Outlook: Tuesday's close negated last week's bullish breakout but has no impact on bullish LT structure. We take a neutral ST view and remain on alert for signs of renewed strength in the coming days to weeks. A weekly close above 1.0820/50 is needed to maintain the interim uptrend.