This week could be full of surprises

It's month end, Q3 end and the H1 end (for those that run a financial year Apr/Mar)

It's time to prepare for some crazy moves as we hit one of the important parts of the year. Adam touched on one aspect of what we might expect form the hedge fund side

Japan has given us an early indication of what we could expect this week as the Nikkei fell today. Traders reported that there was a great deal of profit taking as companies that shut up their half yearly accounts went ex-dividend today. Of the 235 ticks lost today the ex-dividend impact accounted for around 50% of it. There was also some trepidation among buyers to step in on the dip due to the big data week both in Japan and the US

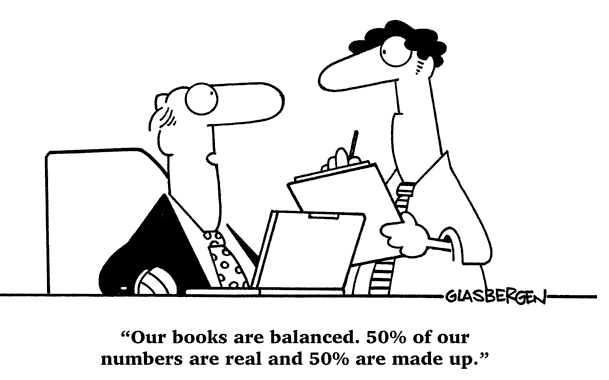

This time of year was always busy on the LIFFE floor as it was one of the two big rollover periods. Being the end of the first half of the financial year most major companies produced half yearly reports and as Adam points out above, there was a certain amount of window dressing done if the results weren't looking too good

For this period we should expect some volatile moves and swings in markets that don't make sense. Unfortunately there's no real way of knowing who is going to do what and when, but the London fix at 15.00 GMT could feature strongly on the FX side all week

Mostly FX moves will come as a result of positioning elsewhere, like the stock market. As firms shift in and out of stocks, bonds and other markets they may create currency imbalances that they wish to either reduce, get out of completely, or hedge

Last Friday was the big futures expiry and rollover so most of the major trades for those were done then. What can happen though is that positions closed Friday may not be re-established until the start of October. The same can happen in stocks where we see a lot of closing of positions from now through Wednesday, which will be reinstated Thursday and Friday

Throw in the usual month/quarter end flows as well (Like the Bundesbank doing the EURGBP FX for the UK EU membership payment) and we potentially have a whole week where we see sudden swift moves in FX

How do we trade it?

The million dollar question. The best way is to look for any moves that come out of nothing and are out of sync with any current intraday trends. For example, if USDJPY suddenly jumps 50+ pips from these lows and the downtrend we're in today, and there's no big news behind the move, then that may signal some Month/Quarter/H1 flows and so the possibility of a fade trade. No one is going to slap a big fat sign up saying "Month end trade happening" so treat each trade as you would normally. Find the levels that you can enter a trade at and define your risk so you're not just jumping in on a whim. As I mentioned above, watch the London fix for signs of these types of moves. If we're going to get some decent action then we'll see prices move about 2-5 minutes before 15.00 GMT and they could run 5-10 minutes after. I've a strong suspicion that the cable moves last Friday afternoon were fix related

On the other side, and if you're in positions, be prepared that you may be see your stops taken out if you're unfortunate enough to see a flow move go against you. Again though, if that happens and there's no real news for the move then you can ask the question about re-entering your position. Have a think about re-positioning your stops around the fix so you're out of the way but have regard for the increased risk you might leave yourself with. Conversely, if you suddenly see a move in your favour out of the blue, ask the question about taking advantage of it or staying put.

For everyone else it's just one of those times of the year when s**t happens for no apparent reason so expect the unexpected

Time to square up for the accountants