ANZ's broad currency themes (in brief):

- EUR/USD is likely to remain sandwiched between competing forces, implying no imminent return of large or persistent currency moves

- GBP, however, remains trending and friendless. We view 1.35-1.40 as the likely bottom of the range

- JPY has finally shown its true colours. We view any rallies in USD/JPY as selling opportunities

- AUD and NZD are elevated, but a turn to weakness seems likely, particularly on some crosses

- In Asia we view recent stability as temporary, particularly in North Asia where the export engine is impaired

- For China, currency stability is likely to persist into some key near-term events. Beyond that we expect further depreciation to return as policy differentials again move against the CNY

More on AUD, CAD and NZD:

- The commodity bloc currencies have surprised us with their resilience

- Recent strength can certainly be explained with reference to relatively stable domestic conditions across all three markets

- While all markets are pricing easing, for instance, none of the central banks seem particularly inclined to deliver into that

- The recent rally in both oil and iron prices has also helped CAD and AUD directly, though to the extent that oil prices have been a broader driver of markets, that has helped to lift all boats

More specifically still on AUD and NZD (bolding mine):

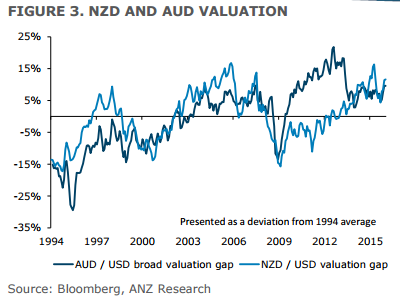

The these moves are taking commodity currencies further away from any reasonable calibration to fair value. Figure 3 presents a currency valuation ... This metric measures how far a currency (in REER terms) is from its longterm average relative to the USD's position relative to its long-term average. When the USD is strong, other currencies should be weak. When the indicator is rising in a strong USD environment (as it has been), it implies that the focus currencies have not been falling to offset the rise in the USD.

This metric suggests the NZD is overvalued by 11.6%, which is not all that far below last April's valuation extreme of 16.3%. The AUD is not as overvalued (9.6%). But apart from the height of the reserve diversification thematic in 2012, the AUD is essentially as overvalued as it has ever been. While it is difficult to see the immediate catalyst for an imminent decline in either the AUD or NZD, and it is certainly true that the multi-year declines in AUD and NZD appear to be quite mature, these sorts of metrics suggest there is still further downside from current levels in trade weighted terms before the current deprecation cycle completes.