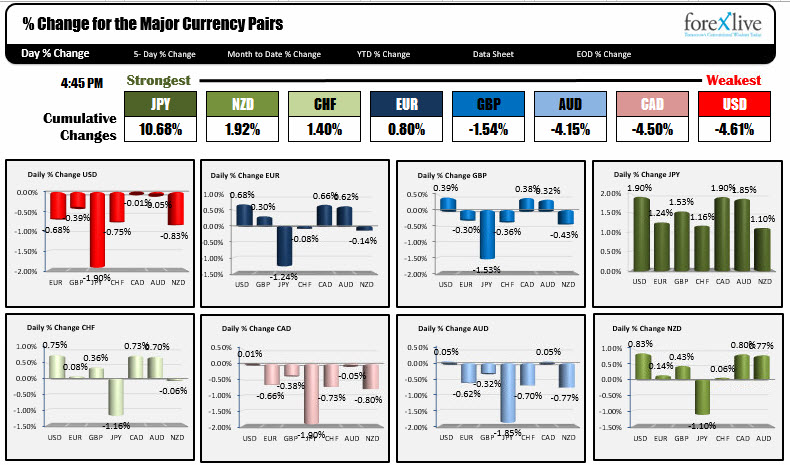

JPY is the safe haven. USD is the weakest.

As North American traders exit for the day, the JPY is the clear winner as the strongest currency, while the USD is the weakest.

The JPY benefited from a flight into the relative safety of the JPY. All the JPY pairs had changes of over 1%. The USDJPY and the CADJPY moved by 1.9%. The AUDJPY changed by 1.85%.

The USD fell the most JPY (-1.90%). The greenback was lower by -0.83% against the NZD and -0.75% against the CHF. The dollar was little changed against the CAD and the AUD.

-----------------------------------------------------------------------------------------------------------

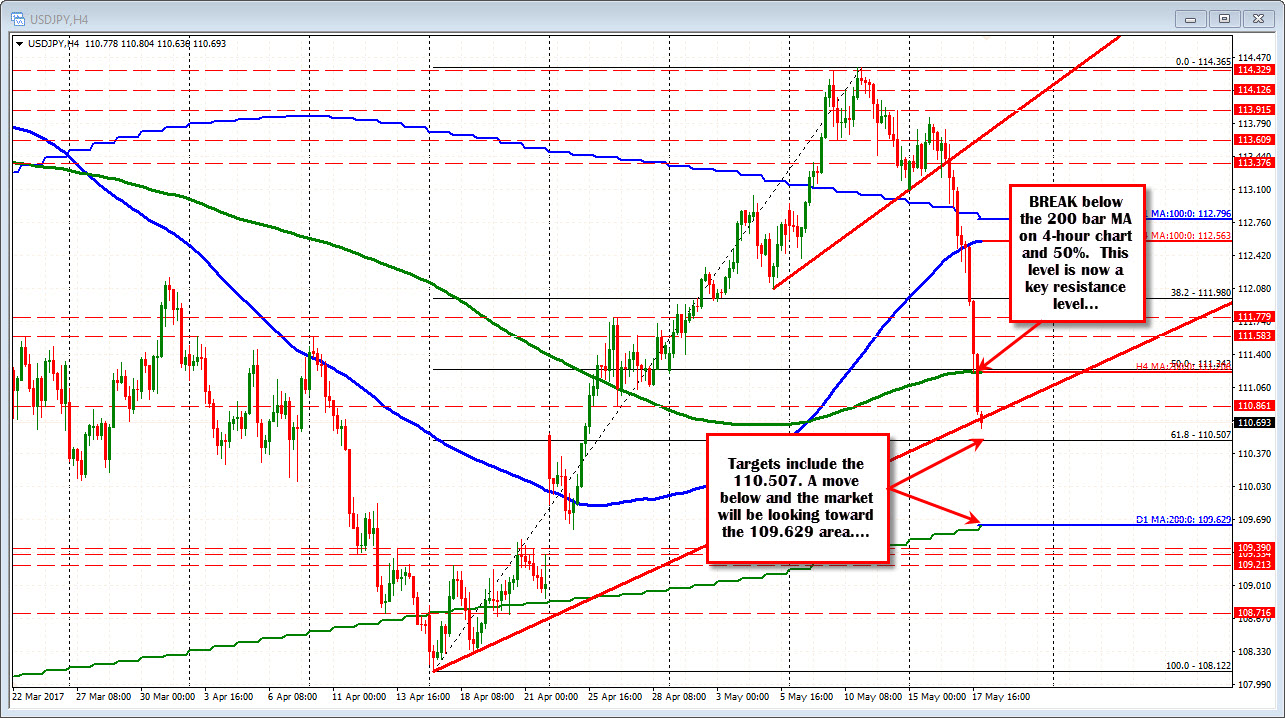

Technically:

The USDJPY tumbled by over 200 pips and is ending the day near the 61.8% of the move up from the April 17 low at 110.507. On the way lower, the pair stalled at the 50% and 200 bar MA on the 4-hour chart at 111.21-24. That is topside resistance now. If there is a rebound, getting back above that level will be eyed for a "bottom is in place" clue.

-------------------------------------------------------------------------------------------------------

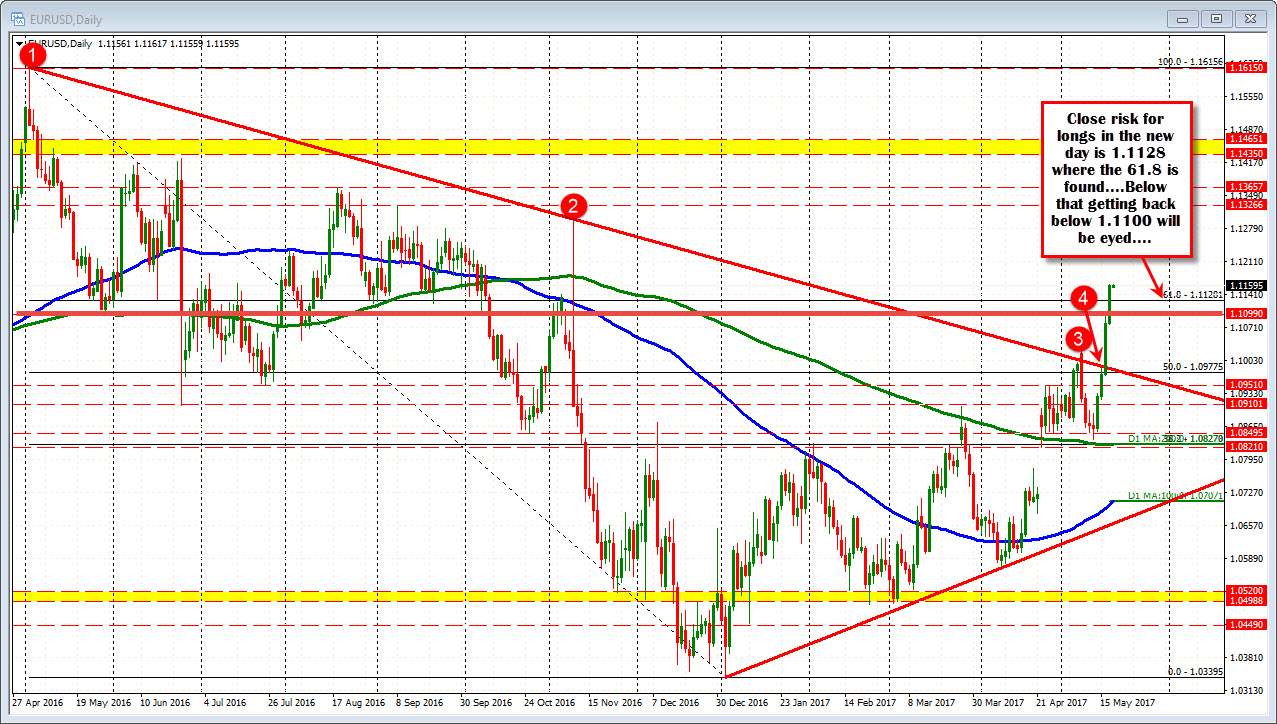

The EURUSD moved above trend line resistance and the 50% of the move down from May 3rd high at 1.0977. The rally continued above 1.1100, and the 61.8% at 1.1128. This is now close support for the pair. Stay above and the bulls remain in control. For a full analysis CLICK here.

--------------------------------------------------------------------------------------------------------

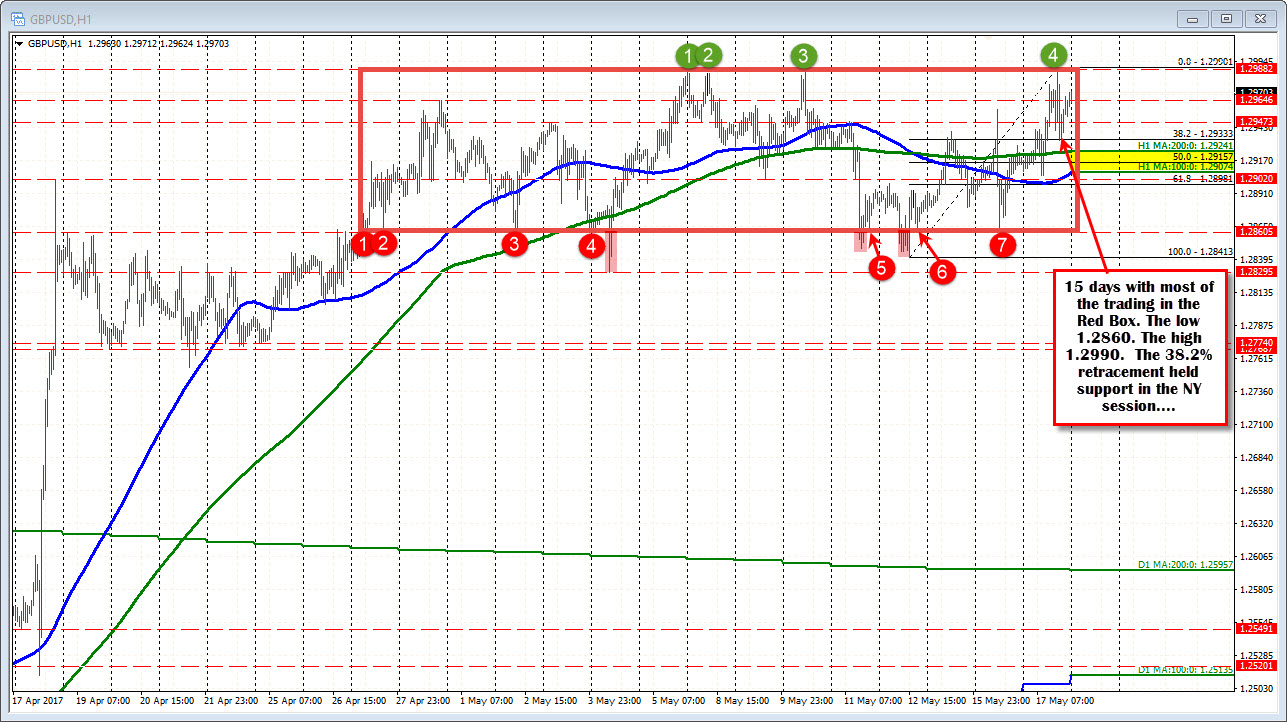

The GBPUSD stayed in the Red Box today, stalling near the high of the 15 day range (the high actually took out the prior highs by a pip or so). The correction off the high stalled at the 38.2% of the last move higher at 1.2933. There is better support near the 100 and 200 hour MA at 1.2907-24. The 1.2900 area is another key support level. The buyers are more in control, but the pair has been moving up and down. Stay above the hourly MAs, and the buyers are more in control. Move below, and the buyers are likely to turn around and sell.