Trades above and below the 100 day MA today.

The USDJPY has seen a good run over the last few days after breaking above trend lines worked on Tuesday at 102.04. The high today has extended to 104.15.

How has some of the cross currency JPY pair looking from a technical perspective. I will start by looking at the EURJPY and follow with some of the other pairs.

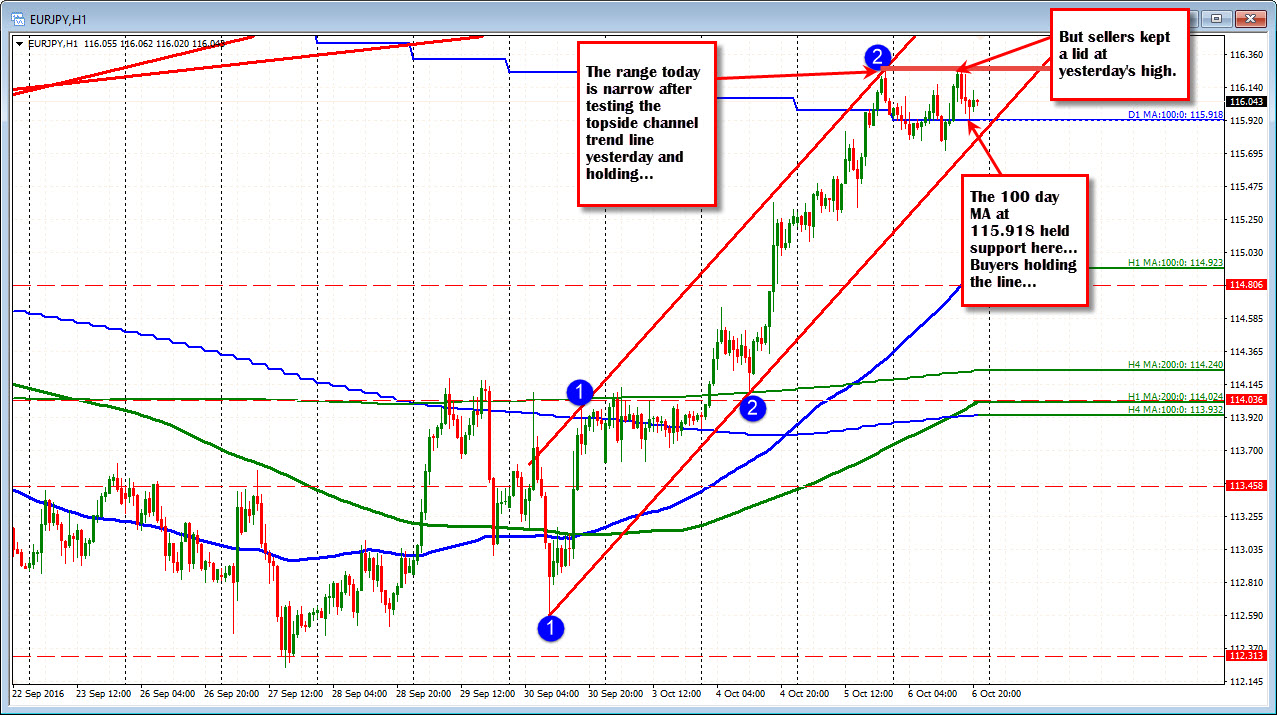

EURJPY sideways action today

The EURJPY is trading in a narrow trading range today as the EURUSD fall is on par with the USDJPY rise. Yesterday the price closed at 115.96. The range today is only 56 pips. The high has seen the price extend up to 116.27 while the low moved to 115.71.

Looking at the daily chart, the pair has been trading around the 100 day MA AND trend line resistance. Both of them are virtually at the same level of 115.918. On a break above such a key technical level, you would expect to see momentum in the direction of the break. This time we are seeing a stall. The market needs the next shove it is taking a breather.

That stall may have taken it's clue from the hourly chart.

Looking at that chart (see chart below), the pair moved up and tested the channel topside trend line at the highs yesterday (at 116.26). That line stopped the pair in it's tracks (profit taking). When traders can define and limit risk they will. The sharp move up from the September 30 low also helped to give traders a cause for pause at the key trend line and key area (from the hourly and the daily chart).

The action in the NY session shows a battle going on. That battle is between the high from yesterday (at 116.26) and the 100 day MA (at 115.918). Notice how the most recent low did find support at that 100 day MA level.

Are buyers showing their hand? It seems that way but the price will have to stay above and ultimately get above the day highs at 116.27, and then old highs from the daily chart at 116.36 (September 2nd high) to give buyers more confidence that there is room for further upside momentum. If those targets can not be breached, since the 100 day MA is still relatively close, there will likely be a break and further correction lower.

Right now though, the bias remains with the bulls/buyers.

.