April 19, 2017.

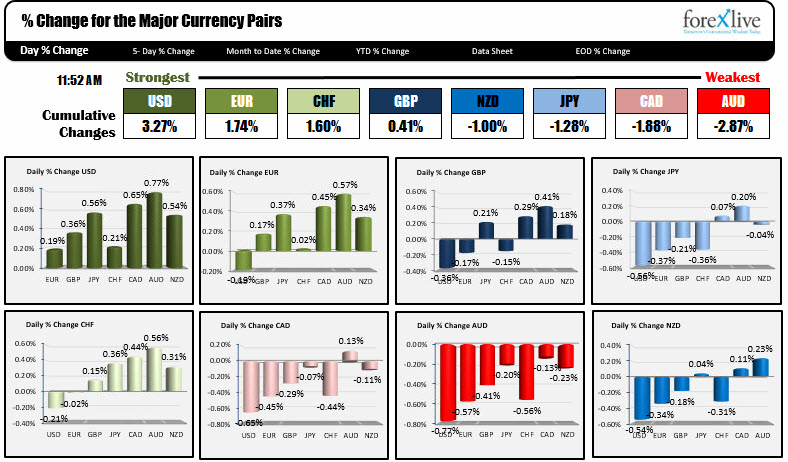

- The dollar is better bid

- Gold is lower

- Oil is lower

- Stocks are higher (except the Dow thanks to IBM)

- Bond yields are rebounding

The USD is doing better as London traders look to exit for the day.

- The EURUSD is in a narrow trading range with support at 1.0700. A move below and the market will be looking toward MAs that were broken yesterday at 1.0680 (200 bar MA on the 4-hour) and 1.0668 (100 bar MA on the 4-hour chart).

- The GBPUSD has spent the last 2-3 hours below the 100 and 200 bar MA on the 4-hour chart at 1.2831 and is testing 1.2800. I can't say the sellers are fully in control, I can say they are winning the day and if they can stay below the 100 and 200 bar MA from above, that giving them more control now. We just broke below 1.2800 and have reached 1.27819

- The USDJPY has the 100 day MA and the 100 hour MA at 108.75-78 below. Stay above is more bullish. The high from yesterday at 109.21 is still putting a lid on the pair today. The high reached 109.175 so far.

Gold is down about $10.80 now to $1278.70. Yesterday we sniffed the key $1300 level. The higher dollar and higher rates are pressuring gold today.

WTI Crude oi is lower by -$0.64. The inventories in crude fell today but less than expectations. We are trading near the lows of the day at $51.68.

Stocks are mixed. The S&P is up +0.28% or 6.5 points. The high was at up about 10 points. The Nasdaq is up 42 points or 0.72%. The high water mark was up 45 points. The Dow has been hit by weakness in IBM whose earnings were less than expectations. It is down -25 points currently.

Bond yields are higher:

- 2 year 1.18%, +2 bp

- 5 year 1.745%, +4.4 bp

- 10 year 2.219%, +5.1 bp

- 30 year 2.879% +4.3 bp