What's WTI oil up to before the inventory data?

Today's inventory data is forecasting a build of 950k vs 1055k build last week. Sources on social media and other news wires today have suggested that the "oil report that shall not be named" showed a draw of somewhere near the 1000k mark. They also suggest that there will be builds in gasoline and distillates, compared to market estimates of draws in both of 1700k & 600k respectively.

Accuracy issues aside, it keeps traders guessing into the actual numbers.

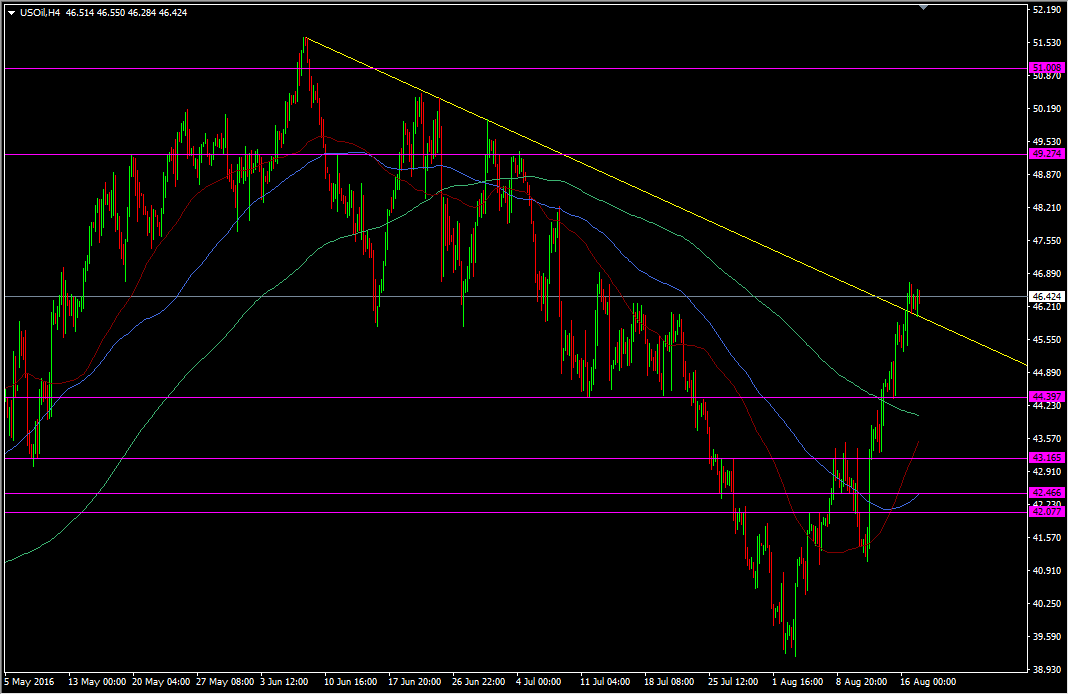

I'm a prior oil post I highlighted the 44.40 area as resistance if the 43.30/50 area broke. We subsequently got a break of both and the 44.40 level became support soon after.

WTI H4 chart

Greg highlighted a trend line break yesterday and we've been hugging that for support today while we await the report. The next upside target is the a minor resistance level at the 12th Jul high around 46.90. We' have further minor levels higher up but things don't get interesting until we get closer to the $50 mark.

The private data may have set the market looking for a draw so the greater risk is that we get a build, which will send the price lower. A matching or bigger draw will see us push further away from the trend line and cement support there.

The inventory report can be a funny one. Sometimes it brings big moves and sometimes not. Sometimes moves last and other times they fade. The current trend is up so we know the market's bias. anything it gets to support that bias keeps the trend going. Anything that goes against that trend but is not a game changer is likely to be faded pretty quickly.

With all these upcoming meetings in Sep, we know the chances are that oil traders get all expectant and keep the price well bid. Again, if we know that sentiment we know how to trade around it.

We'll understand this particular chapter in around an hour.