Deutsche Bank on the euro

One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We don't agree.

First, tapering is not necessarily bullish for a currency. When the Fed signaled taper in mid-2013 the dollar strengthened a lot against EM but it weakened against both the euro and yen.

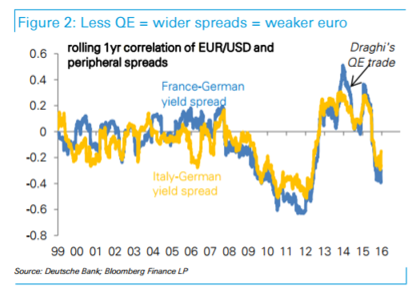

Second, ECB tightening is not that simple. Not only would it steepen curves but it risks a return of redenomination risk that has been conveniently compressed by the ECB's fight against deflation.

Finally, EUR/USD is not just about the ECB but also the Fed and the level of US yields...With the dollar having transitioned to a high-yielder and even more Fed hikes to come, the greenback should be doing a good job of attracting inflows and deflecting its use as a funding currency to both the euro and the yen.

The dollar has had a tough start to start the year but we are not giving up on our bullish view for 2017.

For bank trade ideas, check out eFX Plus.