Reuters out with their first oil poll of the new year

The latest oil poll from Reuters has seen $4.00 - $5.50 shaved off the prior months prices.

- 2016 Brent average price is now seen at 52.52 vs 57.95 prior

- 2016 WTI 49.75 vs 53.73 prior

It's the 7th month on the spin that forecasts have been cut yet they still remain well above current levels. Back in May forecasts were for a 2016 average of $70.90 in Brent.

The average Brent price for 2015 was $53.79

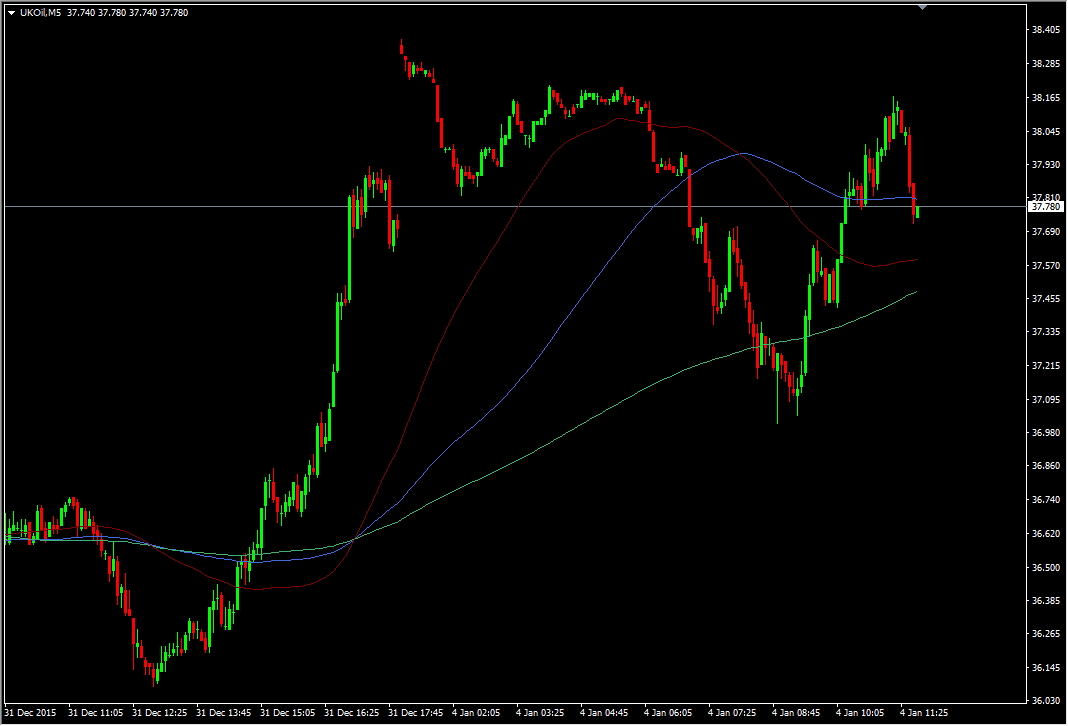

Today saw oil gap higher to 38.50 at the open, on the back of all the Saudi news. That move was quashed fairly quickly and we've seen a low of 37.03. The latest news from Bahrain has poured more fuel on the fire and we've just come off another run to 38.17, and are currently trading at 37.82

Brent crude 5m

If the Saudi/Iran issue develops further then there will be two big opposing forces on the market. The supply issue isn't going to evaporate overnight, while the Saudi issue is volatile and has many unknowns. Middle East unrest is always bullish for oil and while fading any fear moves is often the best trade, the timeframe to do so is key. There's probably a lot more to play out yet and there's big potential to see oil moving higher on increased tensions.

Going on today's price action the market isn't really seeing any major problems yet, but that could change in a heartbeat and shorts are at most risk