The loonie is still on the rollercoaster as oil picks up and the Poloz gets ready to wave his hands about

The Gregster highlighted the 200 dma yesterday and it's had a say in proceedings today.

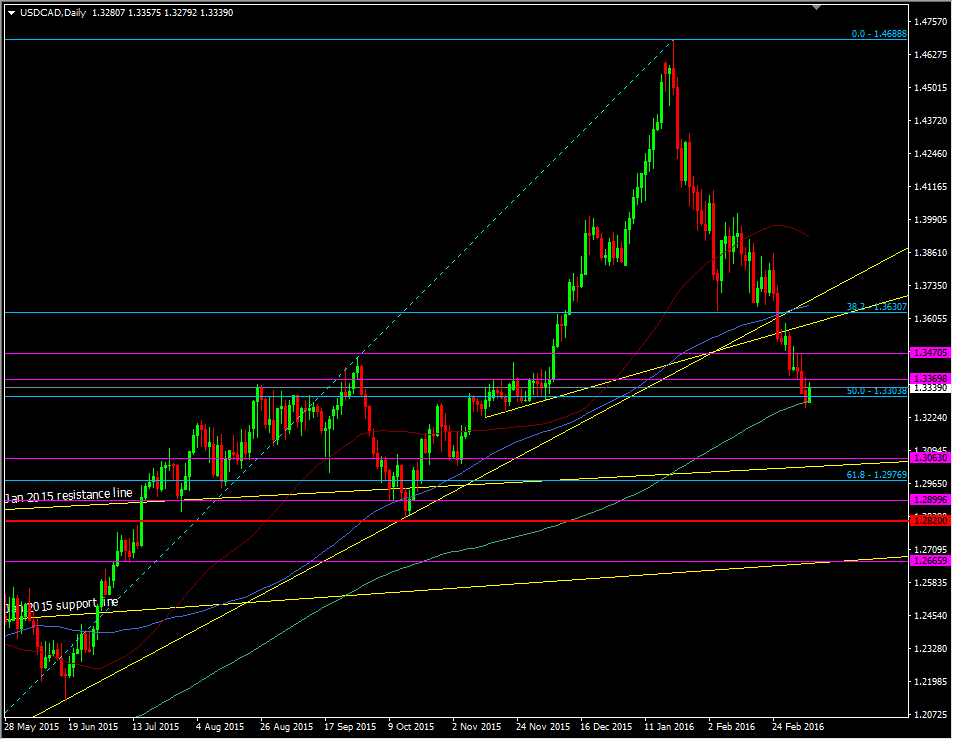

USDCAD daily chart

It's provided the springboard for a move back to older and S&R level at 1.3360/70. If we break through there and 1.3400 then another recent strong level at 1.3450/70 comes into play.

If the 200dma breaks then we could see a sustained push down to the low 1.30's. There's some support levels possible at 1.3220, 1.3200, 1.3180/90, 1.3150/60 and 1.3100. The bigger level below will be at 1.3060/65. This was the Mar 2009 high and became a pivotal level through the latter part of 2015.

There's no real expectation for any action from the BOC tomorrow but there will still be some price risk. Oil is once again playing a big part too. The direct oil/CAD play came apart somewhat but now we're seeing some volatile moves in oil, the loonie will be pulled along for the ride.

My preferred level to look at longs is around 1.2800/20 but there is some good sense in looking carefully at 1.3000 should we get there. It's an area Morgan Stanley highlighted for longs too.

Intraday, the 200 dma is building up as a make or break level. A quick return there will raise the chances of a break, and the level quickly developing as resistance. The price at 1.3370 is asking a question right now, so it can be viewed in the same manner as the dma. Some decent levels for intraday and longer term players to look at.