One level I had my eye on following the big central bank meetings has come into play

We had quite a muted move over the FOMC, due to where the bulk of expectations were. All those who though the Fed wouldn't hike were right and the 24% that thought they would hike got it wrong. Hopefully we'll hear what some of those had to say (BNPP for one) about that later.

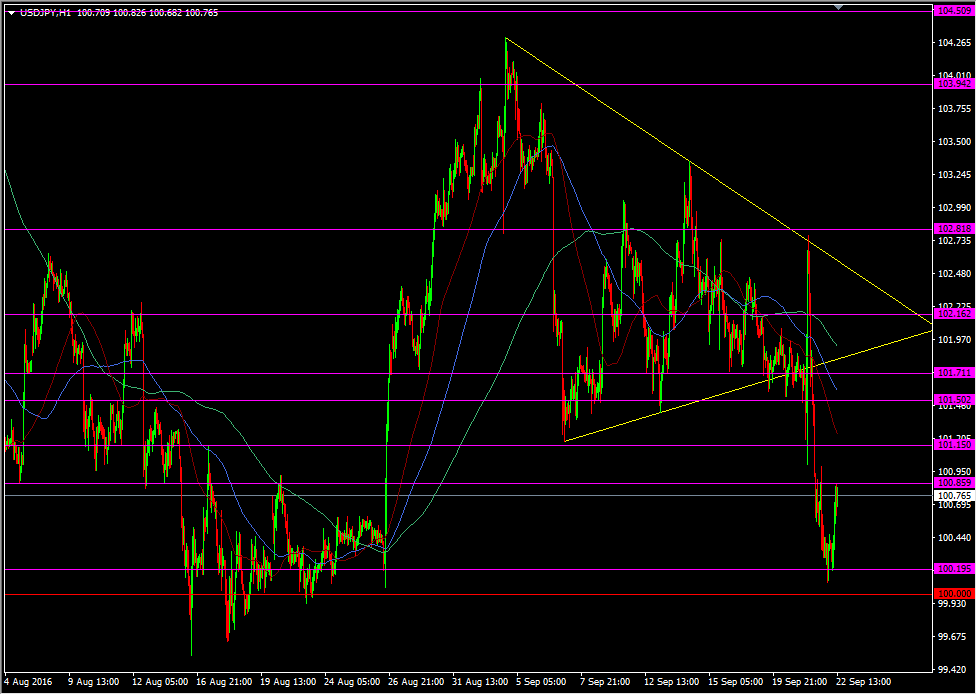

In the meantime, the 100 level in USDJPY became part of the trading picture and we went as low as 100.10.

USDJPY H1 chart

In the FOMC trade ideas thread yesterday I wrote that I would be looking at the 100 level for longs, depending on the outcome of the meeting. I managed to keep up with the news despite being out watching my football team struggle against a team three leagues lower, and late in the evening I scaled in some long orders down to 100. Fortunately I got in with one at 100.15, while the others lower down went unfilled. I've banged on about the 100 level in almost every USDJPY analysis post I do because I feel it is a very big level and one that can't be ignored. Can it blow up? Most definitely. Would I put my house on trading it? Definitely not but when we see theses levels performing as they do, it can mean our risk is potentially reduced exponentially, and that's the whole exercise of trading.

What we now know after the both the BOJ and Fed is that the BOJ are tinkering around the edges and are putting actions in place that will show results (in this pair, good or bad) over a longer period than the Fed hiking or not hiking at any one meeting. The fact the Fed is still looking to hike should keep the buck from straying too far to the downside. The big risk now is what happens after they hike? If the market is still bearish on Japan and the BOJ's policy, and thinks that the Fed will hike and then wait out the next one for many months again, that will be very dangerous for USDJPY. We know where the price was when they hiked last year, and know where it is now. We could be in for more of the same pattern after a hike.

But that's for the future and we need to concern ourselves about the price action right now. 101 is being protected around 100.85/90, a level that's been on my chart for a while. The hard work will continue up at 101.15/20, at 101.40/50 and 101.70/75. We've got minor support at 100.60 and potentially stronger at 100.40, then 100.20, then 100.10, before the big figure.

I think I'll run a manual trailing stop up on my long and at the moment it's just below 100.40. I'll look to see how the US kick their day off and whether we have any further reactions now the yanks have a chance to sleep on last nights events. For the upside, I'm just going to nurse it with a view to seeing how things are, if we get up towards the high 102's where we've struggled recently.

Overall, I don't see any real reason for the recent ranges to break so the 100-103/104 range should remain intact, and we may get back into an inside range of 101-103.